True Cost of Running a Clinic Part 2: In Part 1 of our True Cost of Running a Clinic series we discussed recent trends in opening a solo practice. In this post we will be discussing one of the first steps to starting a private healthcare clinic: creating a pro forma and financing. A pro forma is essentially the lighter version of a full-blown business plan, with revenue and debt projections that are grounded in reality. In a pro forma, one shall account for all of one’s expenses, debt and anticipated revenues. Medical practitioners, like many small-business owners, often need a small business loan or other outside capital to help cover startup costs. If one is already saddled with medical school debt, it can be daunting to ask for more financing. Undercapitalization, therefore is the number one reason for business failure, reports practice management consultancy MBA HealthGroup.

One should also consider startup costs to help pinpoint how much one needs to borrow: real estate, construction, equipment, legal fees, an accountant and consultant fees. Other expenses include computers, medical records software, office furniture and disposable supplies such as gloves, gauze and bandages. Max Reiboldt, president and CEO of the Coker Group consulting firm and author of the book “Starting, Owning, and Buying a Medical Practice” (American Medical Association, 2011), explained the importance of a rational business plan and the absolute need for startup financing. “You’re not going to get capital to start your business without a solid business plan,” Reiboldt said. “We show cash-flow needs and debt projections by month, or at least by quarter.”

One should also consider startup costs to help pinpoint how much one needs to borrow: real estate, construction, equipment, legal fees, an accountant and consultant fees. Other expenses include computers, medical records software, office furniture and disposable supplies such as gloves, gauze and bandages. Max Reiboldt, president and CEO of the Coker Group consulting firm and author of the book “Starting, Owning, and Buying a Medical Practice” (American Medical Association, 2011), explained the importance of a rational business plan and the absolute need for startup financing. “You’re not going to get capital to start your business without a solid business plan,” Reiboldt said. “We show cash-flow needs and debt projections by month, or at least by quarter.”

You also don’t get paid in full at the time of service. Yes, the patient pays a small co-pay usually, but the full payment depends on the insurance companies and occurs weeks after the service was provided. Additionally, while the banks are reviewing one’s pro forma and considering whether to approve your loan request, one also has to prepare to tackle some of the next crucial steps, like signing a lease, determining whether one needs to hire a contractor to modify one’s space, incorporating as a legal entity, obtaining a tax ID, buying liability and malpractice insurance, and credentialing with one’s payers. All of this responsibility and investment often dissuades healthcare professionals from starting their own practice. However, with Symbiosis, healthcare professionals looking to start their own practice can skip many of these steps such as finding a space, signing a lease and seeking extraordinary amounts of capital. Symbiosis takes care of initial and overhead costs and providers only have to pay a monthly flat fee which leads to more time, success and profit for the provider.

References

https://www.businessnewsdaily.com/8910-opening-a-medical-practice.html

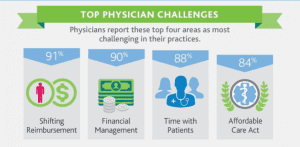

www.hitconsultant.net/2014/03/10/infographic-top-physician-practice-challenges-and-cost-pressures

https://www.businessnewsdaily.com/2616-business-plan-software.html

Symbiosis

1331 H St NW Ste 200,

Washington, DC 20005

(202) 794-6820

– https://goo.gl/maps/Xw6ezHdx53iDi8T98

Our Practice In A Box solutions take all the headaches out of opening and scaling your own private practice. We provide the clinic medical coworking space, operations, management, and more. Do what you do best – practice medicine – and leave the rest to us. From start to finish, we make sure your business is ready and thriving. This is what makes Symbiosis the smarter choice.